Circle of persons submitting real beneficiary declarations has been expanded — Who needs to submit a declaration and in what time period?

11/10/2021

Under the legislative package adopted by the National Assembly on 3 June 2021, the circle of legal entities with the obligation to submit a real beneficiary declaration has been expanded, as well as the concept of real beneficiary, the time periods and procedure for submitting a declaration have been defined.

Who needs to submit a real beneficiary declaration?

From now on, all organisations registered in the Republic of Armenia also need to submit real beneficiary declarations. Moreover, the circle of persons with the obligation to submit a real beneficiary declaration is being expanded in the following 3 stages:

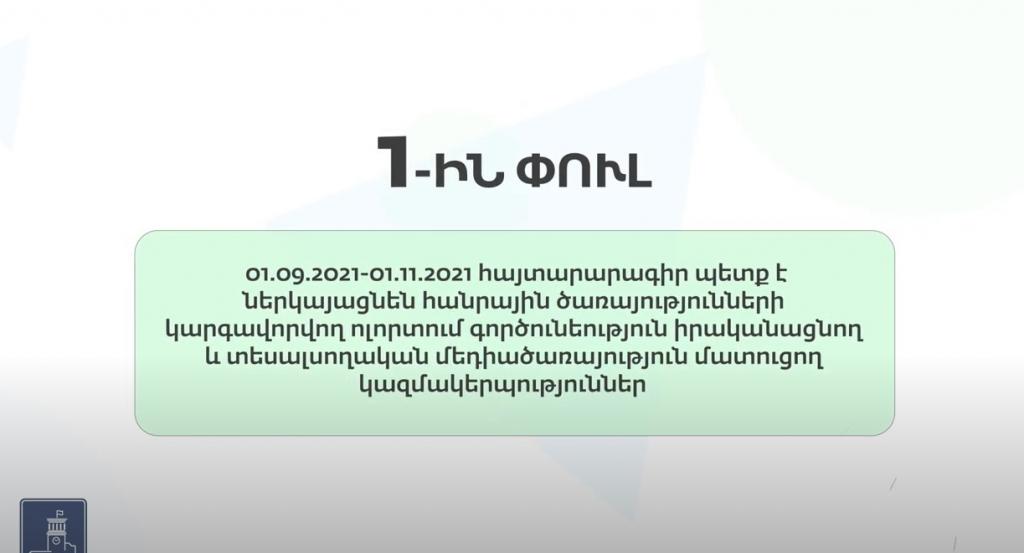

First stage: Organisations carrying out activities in the sphere of regulated public services and providing audio-visual media services need to submit declarations from 1 September to 1 November 2021.

Second stage: All commercial organisations registered in the territory of Armenia need to submit declarations from 1 January to 1 March 2022, except for limited liability companies with only participants who are natural persons.

Third stage: Limited liability companies and non-commercial organisations with only participants who are natural persons need to submit declarations from 1 January to 1 March 2023.

Who is a real beneficiary?

The real beneficiary of a legal entity is the natural person to whom the organisation actually belongs or who actually oversees the organisation. The criteria for becoming a real beneficiary of a legal entity are prescribed by law.

In what time periods and under what procedure should legal entities submit declarations?

Legal entities are obliged to submit a real beneficiary declaration and present future changes in the declaration electronically to the Agency for State Register of Legal Entities of the Ministry of Justice.

To submit the declaration, it is necessary to log into the website of the organisation at bo.e-register.am and fill out and submit the electronic declaration on-line.

Liability is prescribed by law for failure to submit the declaration within the time periods and under the procedure established by law or for submitting false information.